If your company utilizes these materials we suggest you read

FKM & HNBR supply shortages

If your company utilizes these materials we suggest you read

Written by Christopher Stiff

Industry News: (Around a 9-minute read)

If your company utilizes HNBR and/or FKM (Viton®) products, you already know these compounds are in short supply. At this point, we had hoped that a few of the issues that triggered these supply challenges would have diminished; however, there appear to be no quick solutions on the horizon. In fact, we believe things will only get worse before they get better, as recent events (which will be discussed later on in this post) have only added to the mounting uncertainty around rubber availability. When you combine these challenges with other supply chain disruptions, what was supposed to be a very busy drilling season will most likely be remembered for what could have been. A regrettable situation after so many years of struggle; however, not all is lost- we have come up with some unique offerings and general advice to help limit potential disruptions. This post will go over what those are and shed some light on exactly why these shortages are happening.

Inadequate supply of R142b: R142b, which is the feedstock used to make VF2 (vinylidene fluoride)- a key ingredient in the production of FKM is in short supply. Although Covid lockdowns in China have limited the output of R142b, the principal reason for the shortage relates to the drastic increase in demand for battery-grade PVDF. According to SMM (2022), “the burst in lithium demand, especially the rise of LFP batteries, and the recent emergence of 4680 batteries” has outstripped the availability of R142b, of which there are only a handful of producers. In addition, R142b is a hydrochlorofluorocarbon-containing substance which causes damage to the ozone layer. As a result, refrigerant-oriented R142b is subject to production quotas which have caused a steady decline in production these past five years, with further decreases to come (see graph below). These factors lead to a very uncertain future for FKM, of which no one seems to have an answer for when or if things will return to pre-covid accessibility.

Russia, Ukraine, Sanctions, and Carbon Black: Carbon black is a critical ingredient in every rubber compounders mix list. Indeed, carbon black makes up between 40% to 70% of all black rubber compounds (ERJ, 2022). Unfortunately, Russia is one of the largest producers of carbon black, exporting more than 700,000 tons annually (ERJ, 2022). Combine this with Ukraine and Belarus’s production, and you are talking about one-third of the world’s supply (Shunk, 2022). The war and sanctions have obviously caused significant disruptions to the carbon black supply chain. This has forced manufacturers to look at alternative sources such as China and the middle east; however, these are not long-term solutions, and the longer the war continues, the more the strategy becomes untenable. One unconventional option is gaining some traction as a suitable surrogate: recovered carbon black from tire pyrolysis. Andrew Shunk details what it is and where things are headed in this article: https://www.rubbernews.com/opinion/recovered-carbon-black-critical-time-war-europe. However, for the time being, the current Carbon black situation will undoubtedly result in increased prices and shortages for black rubber compounds like FKM and HNBR.

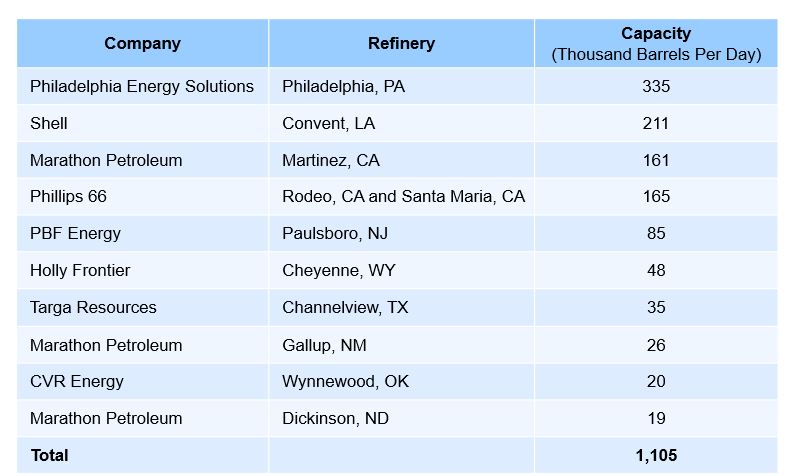

Closure of raw material production facilities: The recent closures of an LG Chem NBR plant in South Korea and the forced closure of a 3M plant in Europe responsible for producing vital ingredients used in FKM are adding to the rubber supply chain woes. Combine this with other refinery closures worldwide (the table below only highlights US refineries that closed during the pandemic), and you get a tight supply of the raw materials necessary for producing the rubber compounds in discussion and others not mentioned in this post.

Source: ADI Analytics 2021

Antidumping duty petition on Acrylonitrile-Butadiene (NBR): A recent U.S. Department of Commerce determination states that France, South Korea, and Mexico are selling NBR at less than fair value in the United States (International Trade Commission, 2022). This ruling is still very recent and requires ratification from the International Trade Commission (ITC), which the ITC has 45 days from June 24, 2022, to decide whether imports from Mexico, South Korea, and France materially injured the U.S. domestic industry (International Trade Commission, 2022). The issue is still evolving, so we will be keeping a close eye on things progress. Should the ITC favour the U.S. Department of Commerce findings, expect to pay quite a bit more for HNBR. More information can be found here: https://www.federalregister.gov/documents/2022/06/24/2022-13560/acrylonitrile-butadiene-rubber-from-france-final-affirmative-determination-of-sales-at-less-than

Alternative Materials: This is a difficult one as there are many reasons why one material should be used over another. In regards to FKM, we would typically recommend a peroxide-cured HNBR compound as a replacement; however, with the current supply challenges with HNBR, you still face delays, although not as bad. Aflas would be your best substitute, as the two materials share a lot in common, although one of the big differences is that Aflas (FEPM) does not contain vinylidene fluoride, which is derived from R142b- big plus. It is more expensive and very difficult to process larger weighted products, but it’s an excellent alternative for sealing parts such as o-rings. Another suggestion would be to switch to a PTFE compound, which offers even better temperature and chemical resistance; however, moving from an elastomer to plastic isn’t always feasible; it depends on the application. Nevertheless, spending time analyzing your application, you’ll sometimes be surprised to find that many other materials or product designs can be better suited for your application or be used as an alternative.

Our Super Sub Program: There is a lot of inherent risk in single sourcing any product during uncertain times. That’s why spreading your usage of manufactured products amongst multiple suppliers is one of the easiest ways to reduce the probability of disruptions. Our Super-Sub program is an affordable multi-sourcing arrangement on compression molded parts that can help limit the negative impacts related to single sourcing. It’s one of our most popular offerings and has helped many clients reduce risk and save money on their rubber products. What makes the program unique is there is no need to pay for a mold, as we have in-house mold-making capabilities and can absorb this cost. What we ask for in return is a share of your moderate to high usage molded rubber parts. If your company is interested in learning more about the super sub program, click on the link to the right to set up a phone call or ZOOM meeting. https://meetings.hubspot.com/christopher-stiff/kc-seals-meetings

Join our early bird list: In addition to our Super Sub program, KC Seals has added another flexible option for your company to explore: KC Seals has placed call-off orders with our most trusted compounders. The materials list includes popular HNBR and FKM 80 and 90 compounds specifically formulated for the oil and gas sector. How the early bird list works- within our call-off orders, we have an added overage above what is allocated for customer orders. That overage is meant for clients struggling to source molded products from their primary vendors or any new projects requiring these compounds. Once the material arrives at our facility, we send out an email stating what compound has come in and how much. The first to reply can secure some to all of the amount received to help meet their requirements. To learn more about what materials are included on the list and how to join, simply click on this link https://share.hsforms.com/1nRUBZnFCSpa06XE_NWFuig1ogcq or just reply to this email and ask to be added to the early bird list.

No mind-blowing epiphanies here, but just some general advice to keep in mind during these uncertain times.

Hold stock: During these supply challenges, we cannot guarantee to hold prices or delivery within typical, expected timeframes. We suggest carrying a buffer stock of finished goods to reduce your risk of disruptions. Furthermore- something to keep in mind: raw rubber compounds have a shelf life of weeks or months, whereas vulcanized rubber (your finished product) will last at least 5-7 years.

Allow longer lead times: Although difficult to predict, the best action you can take is to plan ahead. We suggest ten weeks if possible, as we have seen delays in FKM and HNBR delivery this long and sometimes longer.

Pre-warn your customers of delays: If what is mentioned above is not possible, we urge you to warn your customers of the current situation regarding FKM and HNBR shortages. Feel free to share this post to provide better insight into the issues.

ERJ, (April 20, 2022). Scramble continues for carbon black supplies. European Rubber Journal. Available from: https://www.european-rubber-journal.com/article/2091263/scramble-continues-for-carbon-black-supplies

International Trade Commission, (June 24, 2022). Acrylonitrile-Butadiene Rubber From France: Final Affirmative Determination of Sales at Less Than Fair Value, and Final Affirmative Determination of Critical Circumstances, in Part. Federal Register. Available from: https://www.federalregister.gov/documents/2022/06/24/2022-13560/acrylonitrile-butadiene-rubber-from-france-final-affirmative-determination-of-sales-at-less-than

Schunk, A. (April 04, 2022) Schunk: Fog of war clouds EU carbon black forecasts. Rubber News. Available from: https://www.rubbernews.com/opinion/recovered-carbon-black-critical-time-war-europe

Singh, S, and Turaga, U. (2021). Pandemic continues to push U.S. refinery closures and shift to renewable fuels. ADI Analytics. Available from: https://adi-analytics.com/2020/11/22/pandemic-continues-to-push-u-s-refinery-closures-and-shift-to-renewable-fuels/

SMM, (April 11, 2022). Battery-Grade PVDF Prices Keep Surging on R142b Shortage. SMM. Available from: https://news.metal.com/newscontent/101801778/battery-grade-pvdf-prices-keep-surging-on-r142b-shortage

Turner, E. (January 19, 2022). Global refinery closures outweigh new capacity in 2021: IEA. S & P Global. Available from: https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/oil/011922-global-refinery-closures-outweigh-new-capacity-in-2021-iea